Can You 1031 into a REIT? – Did You Know?

The short answer is yes, you can 1031 into a REIT. However, it is not as direct as you may think. If you want to 1031 into a REIT you must go through a few processes.

Are you a real estate investor looking for innovative ways to maximize your profits while deferring taxes? The 1031 exchange offers a unique opportunity to reinvest your capital gains into a Real Estate Investment Trust (REIT). In this blog post, we will delve into the benefits of executing a 1031 exchange into a REIT and explore how it can help you diversify your portfolio and achieve long-term wealth growth.

Understanding the Basics of a 1031 Exchange

A 1031 exchange, also known as a like-kind exchange, is a provision in the U.S. tax code that allows real estate investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property or properties. However, many investors are unaware that they can also utilize this strategy to invest in REITs.

What is a REIT?

A REIT is short for a Real Estate Investment Trust. REITs are pooled investment structures designed to invest in Real Estate Investment Properties. The goal of REITs is to provide a passive way for investors to invest in the real estate market.

Generally investors receive dividend income from the rental income the properties generate.

There are plenty of REITs out there both on the public and private side. Public REITS can be purchased on the stock market, while private REITS tend to not be as accessible.

How Does a REIT Qualify for 1031 Exchanges?

In order to qualify for a 1031 Exchange, an investor must identify another investment or like kind property to move the proceeds into. REITs own a diversified portfolio of many properties and because of this you have to use a loophole. You must move proceeds into a DST before the assets can be moved into a REIT.

This is how investors can move their investment properties into a REIT.

What is an UPREIT?

An UPREIT, also known as an Umbrella Partnership Real Estate Investment Trust, is the process of moving your share/ownership of a real estate investment property into a REIT.

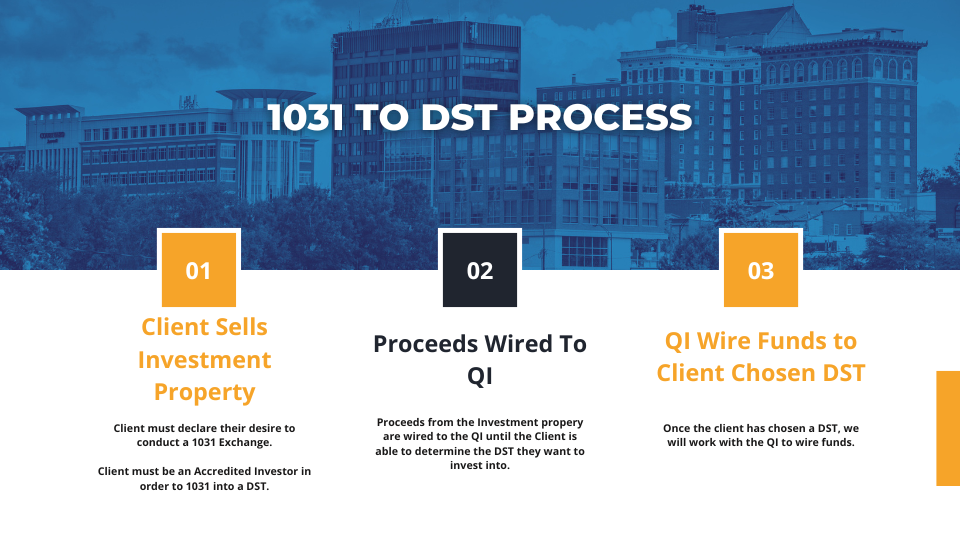

Process of Moving a 1031 into a REIT

Investment Property is Sold and Proceeds are moved to your desired QI (Qualified Intermediary).

IntelliVest Wealth Management will work with the client to identified the DST the Client is comfortable moving their proceeds into.

QI wires funds to the proper DST.

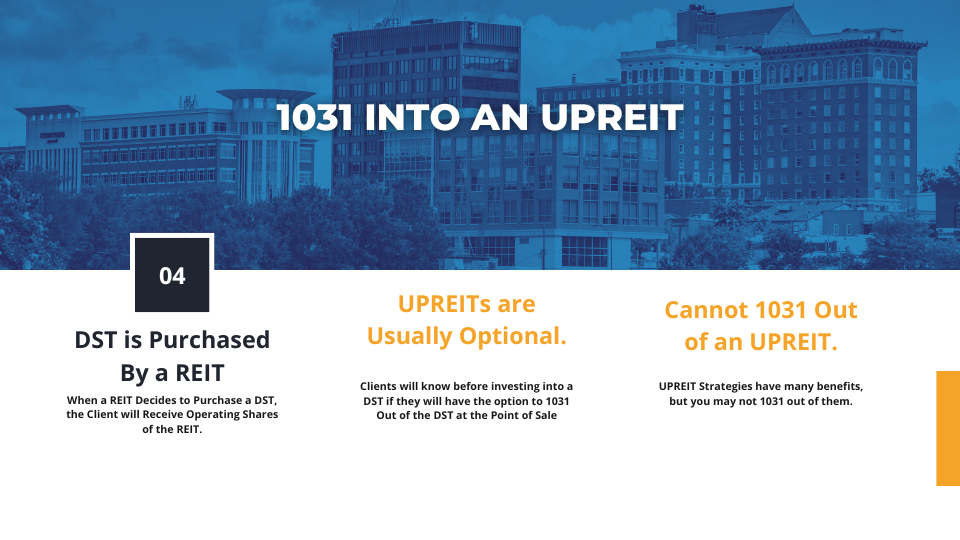

DST is purchased by a REIT.

Investor will receive fractional shares of the REIT.

Exploring the Advantages of a 1031 into a REIT

Diversification and Professional Management: REITs offer investors the opportunity to diversify their real estate holdings without the hassle of direct property management. By pooling resources with other investors, REITs allow access to a wide range of properties such as residential, commercial, or industrial, spread across different geographic locations.

Liquidity and Market Exposure: Unlike direct real estate investments, REITs are traded on major stock exchanges, providing investors with liquidity and the ability to easily enter or exit their positions. Moreover, REITs provide exposure to the broader real estate market, allowing investors to benefit from potential appreciation and income generation.

Passive Income and Dividends: REITs are required by law to distribute a significant portion of their income to shareholders. This makes them an attractive investment option for those seeking regular cash flow and passive income. Investors can enjoy dividends generated by rental income, offering potential stability and consistent returns.

Check out our 10 Reasons to Consider a DST Article.

Eligibility and Considerations for a 1031 Exchange into a REIT

Like-Kind Requirement: To qualify for a 1031 exchange into a REIT, the investor must ensure that the sold property and the Real Estate investment both meet the like-kind requirement. While most real estate properties qualify, certain types, such as personal residences, do not. A DST is the most common way to 1031 into a REIT.

Replacement Property Identification: One crucial aspect of a 1031 exchange is identifying the replacement property within a specific time frame. When considering a REIT investment, it’s important to research and select a suitable REIT that aligns with your investment goals. DSTs can qualify as a replacement property for a 1031 Exchange.

Consultation with Tax and Legal Professionals: Executing a 1031 exchange can be complex, involving intricate tax regulations and legal considerations. It is highly recommended to consult with qualified tax and legal professionals who specialize in real estate transactions to ensure compliance and maximize the benefits of the exchange.

Case Study: A Successful 1031 Exchange into a REIT

To illustrate the potential of a 1031 exchange into a REIT, let’s consider a hypothetical scenario. John, a real estate investor, owns a commercial property that has appreciated significantly over the years. Instead of selling the property and incurring substantial capital gains taxes, John decides to execute a 1031 exchange, reinvesting his proceeds into a REIT that focuses on industrial properties. By doing so, he diversifies his holdings, gains exposure to a different real estate sector, and enjoys regular dividends.

Conclusion to 1031 into a REIT

A 1031 exchange into a REIT can be a strategic move for real estate investors seeking tax deferral, portfolio diversification, and passive income. By leveraging the power of this tax provision, investors can unlock new avenues for long-term wealth growth. Remember to thoroughly research REIT options, consult with professionals, and ensure compliance with IRS guidelines. Embrace the potential of a 1031 exchange into a REIT and take your real estate investment journey to new heights.

Risks:

If you are interested in moving your proceeds from a 1031 into a DST, or any of the investment structures mentioned in this article, please be aware of some of the risks:

You are subject to investment risk. As with any investment, there is always the risk of your investment going down in value.

Both DSTs and REITs are generally considered to no be liquid investment strategies. This means that the month invested into them is not as easily accessible as public stocks that could be sold on a day to day basis. This should be considered when deciding whether these strategies are right for you.

Once you 1031 Exchange into a REIT you will no longer be able to conduct a 1031 again.

Disclosure

IntelliVest Wealth Management is a Registered Investment Advisor Headquartered in Spartanburg South Carolina. This is not a solicitation. Please consult with IntelliVest Wealth Management about your personal financial situation.